stock option tax calculator uk

Click to follow the link and save it to your Favorites so. Please enter your option information below to see your potential savings.

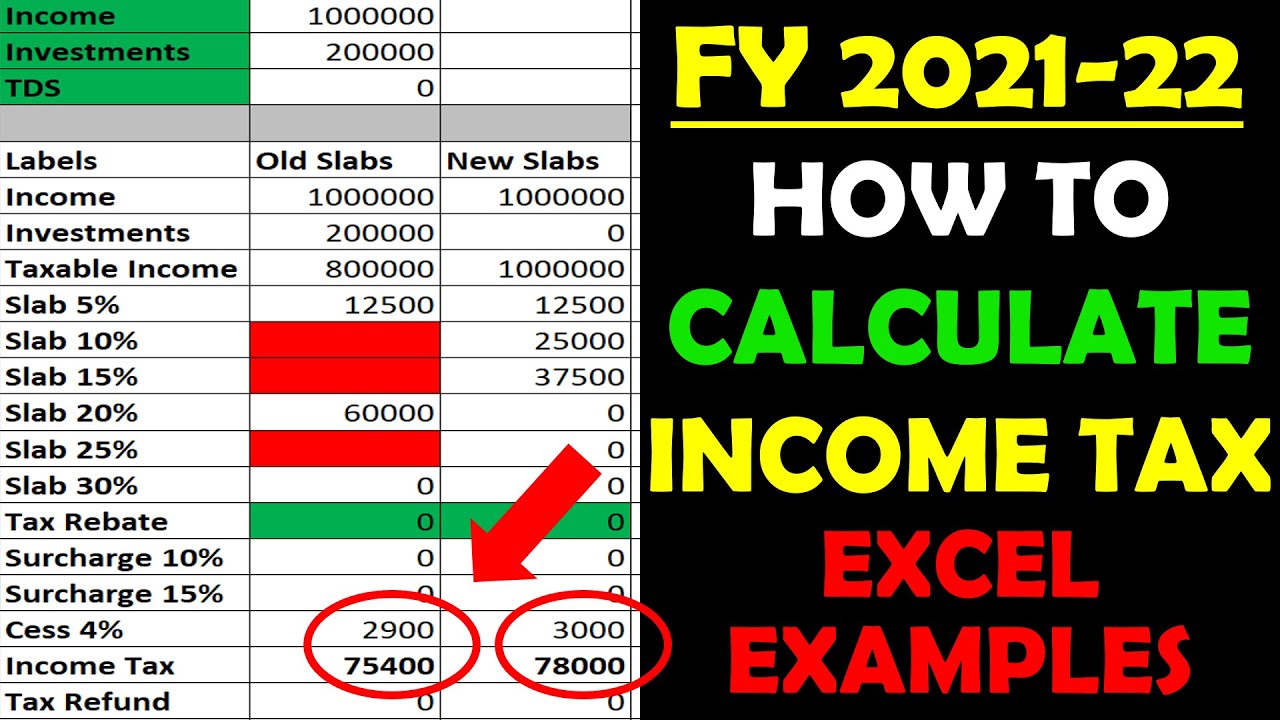

Income Tax Calculator For Fy 2021 22 Ay 2022 23 Free Excel Download Commerceangadi Com

Ad From Implied Volatility to Put-Call Ratios Get the Data You Need.

. Prior to buying or selling an option a person must receive a copy of Characteristics and Risks of Standardized Options. Stamp Duty Reserve Tax SDRT when you. Fees for example stockbrokers fees.

Normal capital gains tax rules apply on the sale and you will pay tax at any gain above the annual exemption at either 18 or 28 depending upon your income elsewhere. The Stock Option Plan. Taxes for Non-Qualified Stock Options.

The Stock Calculator is very simple to use. Enter the purchase price per share the selling price per share. Exercising your non-qualified stock options triggers a tax.

Only for employees tax favored treatment which is as low as. The following calculator enables workers to see what their stock options are likely to be valued at for a range. This calculator illustrates the tax benefits of exercising your stock options before IPO.

Even after a few years of moderate growth stock options can produce a. Locate current stock prices by entering the ticker symbol. Find the best spreads and short options Our Option Finder tool.

Ad Fidelity Can Help You Manage Risk and Plan For the Future You Desire. How much are your stock options worth. From a UK employment tax perspective the granting of an ISO to an employee of a UK subsidiary entity typically does not confer any tax advantages.

NSO Tax Occasion 1 - At Exercise. Cash Secured Put calculator addedCSP Calculator. Ad From Implied Volatility to Put-Call Ratios Get the Data You Need.

Employee Stock Option Calculator for Startups Established Companies. Poor Mans Covered Call calculator addedPMCC Calculator. The Stock Option Plan specifies the total number of shares in the option pool.

Section 1256 options are always taxed as follows. This permalink creates a unique url for this online calculator with your saved information. Just follow the 5 easy steps below.

When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share. Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in. Stock Option Calculator Canadian Receiving options for your companys stock can be an incredible benefit.

There are two types of taxes you need to keep in mind when exercising options. Receiving options for your companys stock can be an incredible benefit. Even after a few years of moderate growth stock options can produce a handsome return.

Lets say you got a grant price of 20 per share but when you exercise your. Some employees have pay packages that include the issuance of employee stock options. In our continuing example your theoretical gain is.

If the company issuing incentive stock options adheres to the rules as. Options involve risk and are not suitable for all investors. 60 of the gain or loss is taxed at the long-term capital tax rates.

Ordinary income tax and capital gains tax. If you exercise an option to acquire vested shares in an unapproved share scheme then you will be liable to UK PAYE and National Insurance on the difference between the. Non-tax favored Options UK ISO US NSO US Restricted Stock US Restricted Stock UK Summary.

40 of the gain or loss is taxed at the short-term capital tax. You can deduct certain costs of buying or selling your shares from your gain. Enter the number of shares purchased.

Ad Fidelity Can Help You Manage Risk and Plan For the Future You Desire. The stock options will automatically be. The stock options were granted pursuant to an official employer Stock Option Plan.

![]()

Ir35 Calculator Uk Tax Calculators

Capital Gains Tax Worksheet Excel Australia Capital Gains Tax Capital Gain Spreadsheet Template

Pin On Very Much Like A Business

Your Most Common Home Security Questions Answered Accounting Services Accounting Bookkeeping Services

Eso Fund Helps You To Plan The Best Time To Exercise Your Employee Stock Options Consider Some Factors Like Vesting Date Expirati Stock Options Incentive Tax

Ir35 Calculator Uk Tax Calculators

Self Assessment Calculator And Deadlines Money Donut

Limited Company Tax Calculator Employed And Self Employed

Crypto Taxes Hmrc Eofy Tax Deadline 31st Jan 2022 Koinly

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax Fy 2021 22 Excel Examples Income Tax Calculation Fy 2021 22 Youtube

Self Assessment Calculator And Deadlines Money Donut

Deductions Under Chapter Vi Calculator Deduction Calculator Chapter

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

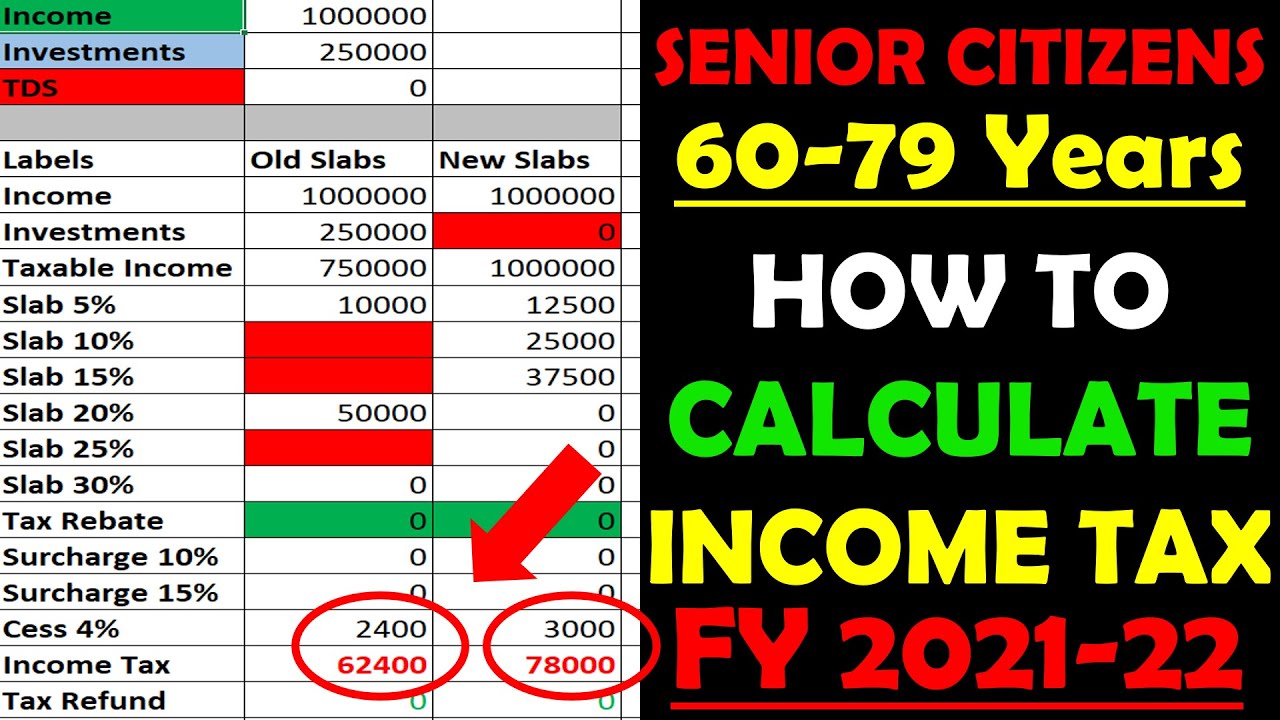

How To Calculate Income Tax Fy 2021 22 Excel Examples Senior Citizens Age 60 To 79 Years Youtube

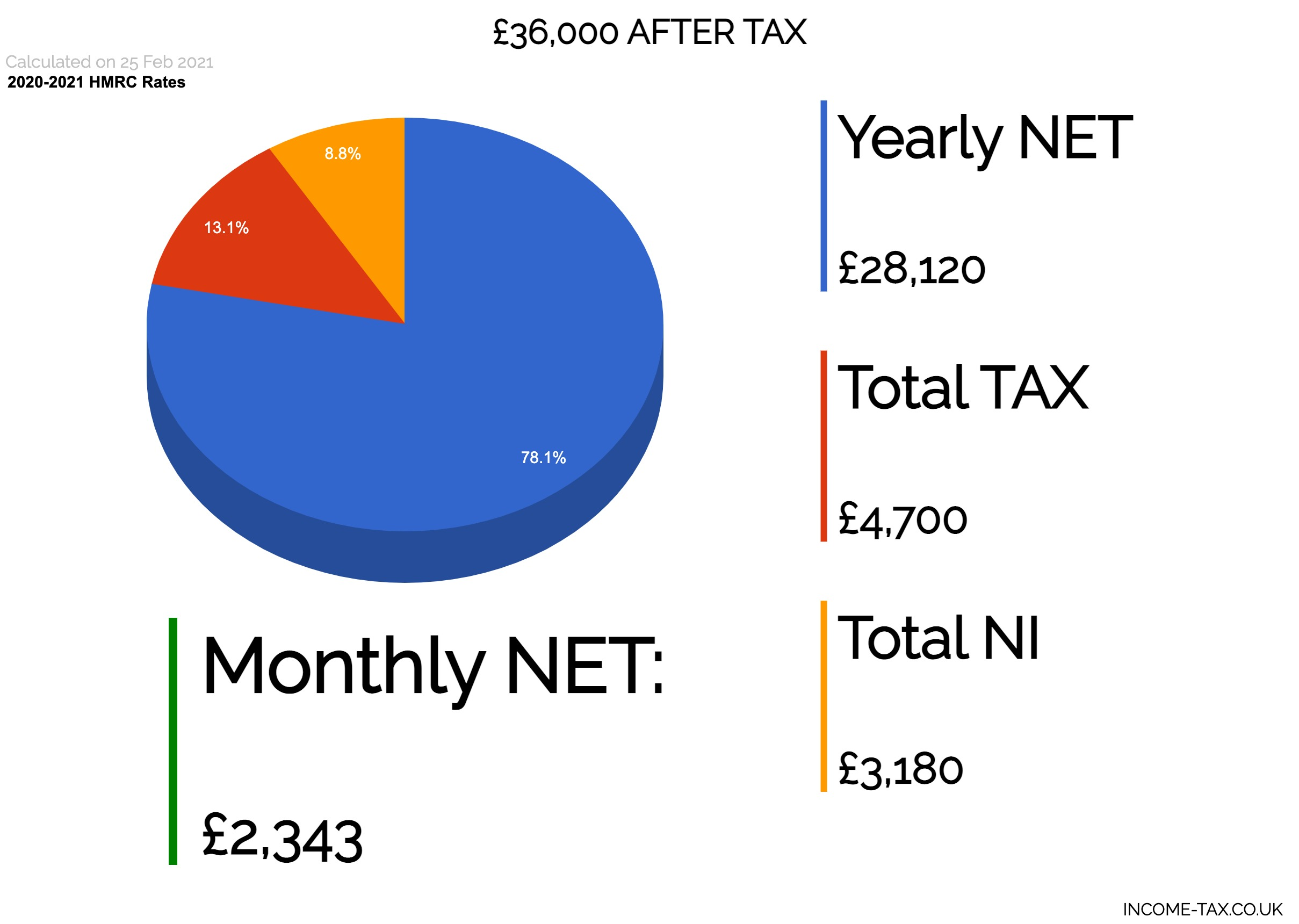

60 000 After Tax 2021 Income Tax Uk

Tax On Bonus How Much Do You Take Home Uk Tax Calculators